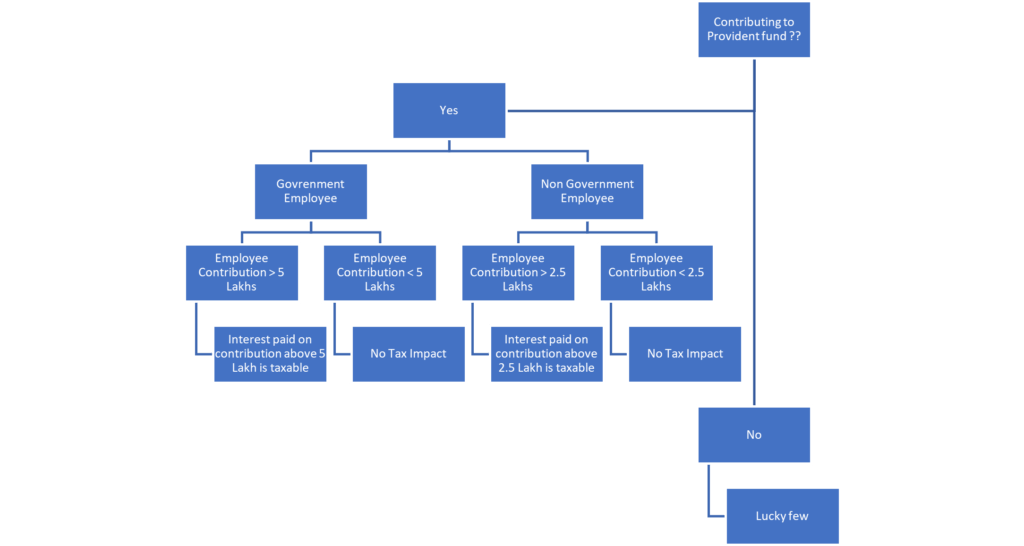

In the Union Budget 2021, Finance Minister Nirmala Sitharaman had announced that the interest earned on employees contributions to their provident fund (EPF) in excess of Rs 2.5 lakh a year will be subject to tax.

The government had then said that the move would affect less than 1 percent of tax-payers. That is, primarily high-earners whose basic annual salary is over Rs 21 lakh (Rs 1,73,612 a month). For government employees, this EPF contribution threshold is higher at Rs 5 lakh. This has come into effect from financial year 2021-22 (assessment year 2022-23).

Employers deduct 12 percent of your basic salary as your contribution to EPF every month, add a matching amount as their contribution and deposit it with the EPFO. If the amount deducted as your contribution is over Rs 2.5 lakh/Rs 5 Lakh (whichever applicable) in a financial year, the interest earned on this excess amount will be taxed as per the slab rate applicable to you. If you have made any additional, voluntary contribution during the year, that will also be taken into account.

Calculation of taxable interest relating to contribution in a provident fund or recognised provided fund, exceeding specified limit.-

For the purpose of calculation of taxable interest, separate accounts within the provident fund account shall be maintained during the previous year 2021-2022 and all subsequent previous years for taxable contribution and non-taxable contribution made by a person.

(a) Non-taxable contribution account shall be the aggregate of the following, namely:-

(i) closing balance in the account as on 31st day of March 2021;

(ii) Contribution made by the person in the account during the previous year 2021-2022 and subsequent previous years upto contribution in excess of 2.5 Lakh or 5 Lakh); and

(iii) interest accrued on sub- clause (i) and sub- clause (ii), as reduced by the withdrawal, if any, from such account;

(b) Taxable contribution account shall be the aggregate of the following, namely:-

(i) contribution made by the person in a previous year in the account during the previous year 2021-2022 and subsequent previous years, which is in excess of the threshold limit (i.e. 2.5 Lakhs or 5 Lakhs); and

(ii) interest accrued on sub- clause (i), as reduced by the withdrawal, if any, from such account;